The world is becoming increasingly digitized, so the time has come for economy to go digital too. Financial institutions and payment providers are moving to integrate blockchain technology into their systems to be the first to open the door to modern finance for their clients. Let's look at what makes the current financial infrastructure outdated and inefficient and how blockchain is changing that.

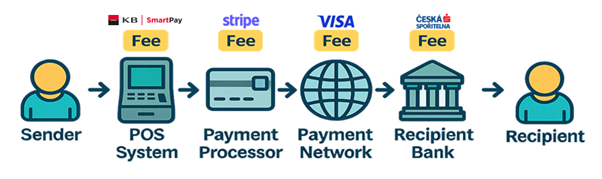

Credit card and debit card transactions are the most common payment rail for consumer to merchant transactions. At first glance it may seem that the payment goes straight from your card to the merchant’s bank account, but in reality, these kinds of transactions have to go through multiple channels before they are routed to the banks to be settled.

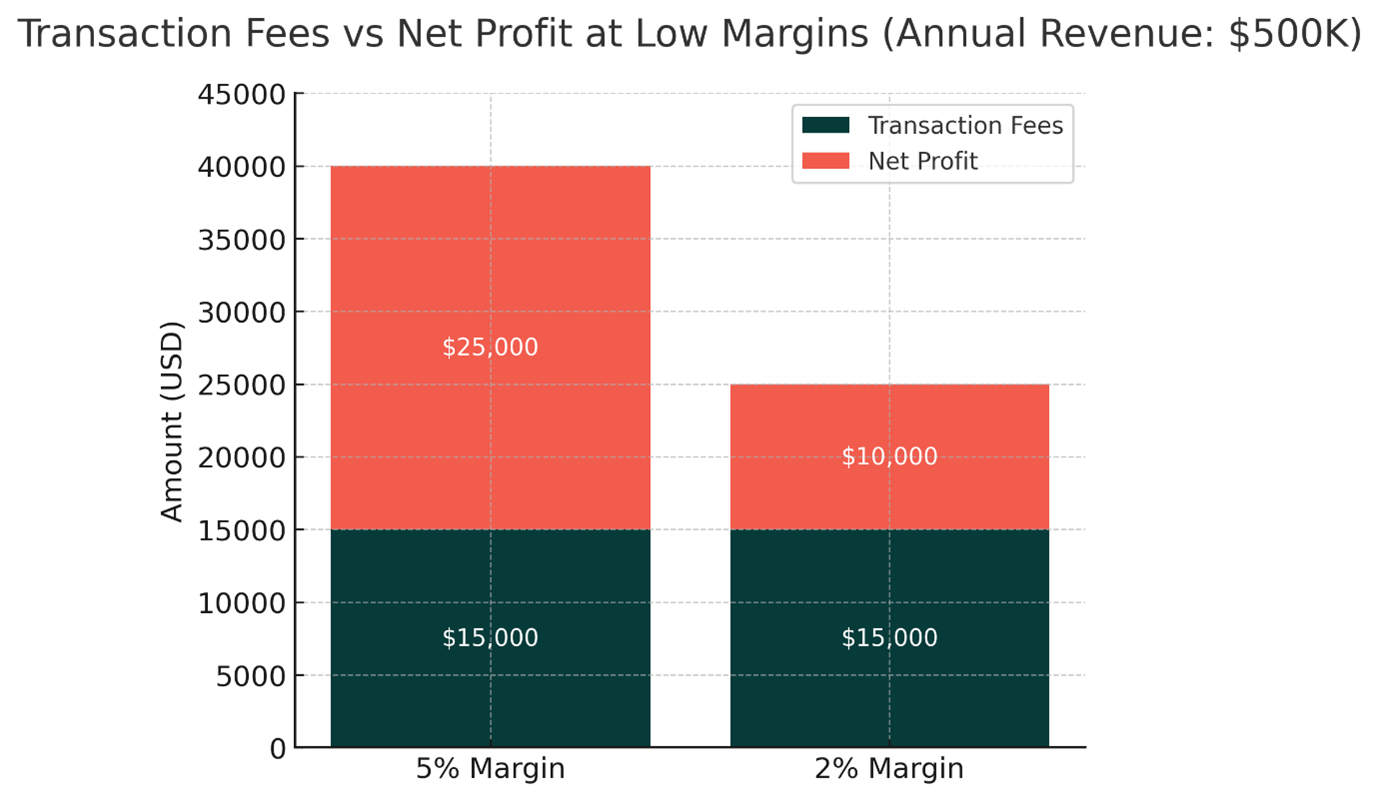

The problem with having so many middlemen in these transactions is that they each charge a fee, which amounts up to a few percent of the transaction. As a result of that, low margin businesses can lose out on a significant portion of their potential earnings. There is also a significant delay between when the customer swipes the card and when the merchant has the funds at their disposal, which can take up to two days. This significantly impairs the merchant's cashflow and is a step backwards even compared to cash payment.

International wires are the method which banks employ to send money across international borders. The sending bank is free to determine the exchange rate. These transactions often have to go through intermediary banks to reach their destination.

Banks charge high fees for these kinds of transactions and intermediaries charge additional fees. Banks usually set a unfavourable exchange rate on which they also profit significantly. As a result, if you were to send a $500 transfer you are likely to be charged close to $50 (depends on the region). On top of this, the transfer could take up to 3 business days to go through which delays the settling of the commercial transaction.

Real-Time Payments are the fastest method for banks to settle transactions. The way it works is that the participating banks have to contribute to the shared pool of money and then settle the transactions instantly by adjusting their books.

The trade-off for the convenience of having instant settlement is significantly higher fees. Specifically, the fees tend to be ~2-5 times higher than standard bank transfers (depends on the region). On top of that, real-time transactions are generally domestic systems, not available to all banks, and not integrated to any international systems, which significantly limits where you can send money through these channels.

In addition to all the other drawbacks of all these payment rails, none of them are widely available in places with poor banking infrastructure, e.g. third-world countries. That means that they don't have access to a significant share of the global market.

Blockchain based transactions aim to solve the aforementioned shortcomings and streamline the global transaction market. The advantages of sending USD (and other currencies) via blockchain are that transactions are settled within only a few seconds and with negligible fees, combining the convenience of cards and the efficiency of cash payments. Additionally, they aren’t reliant on traditional banking structures and only require that the two parties in the transaction have access to the internet with mobile phone or laptop. Blockchain payment models are better than traditional payment platforms in just about every way. When you combine this with the fact that they can serve the unbanked, you realise that there isn’t a person on the planet who isn’t a potential customer.

Current mainstream payment rail providers have taken notice of the inevitable impending adoption of blockchain payments. In an attempt to prevent this from taking over their business payment rail providers such as Visa, Mastercard, Stripe and PayPal have all formed partnerships with blockchain payment companies or acquired them, to build their own blockchain payment solutions. Despite their efforts, the market for payment services is becoming more saturated, which will force the legacy companies to reduce their fees, positively impacting both merchants and consumers.

Some companies that may still be in early stages at this point will play an important role in this emerging economic landscape. Established companies that fail to adapt will gradually start to fade away. At WOOD & Company we realise that now is the time to capitalize on this. Blockchain+ Sub-Fund was founded to provide investors with a long-term and comprehensive exposure to the top performing areas in this growth sector, and we are excited to have blockchain payment providers in our portfolio.

Authors: Nicholas Newbold & Tomáš Kalabis, WOOD & Company Blockchain+